PGDM BANKING AND FINANCIAL SERVICES (BFS) PROGRAM

Two-year full-time AICTE approved and AACSB accredited residential program in Business Management.

PGDM Banking and Financial Services program (BFS) at IMT Ghaziabad

Approved AICTE intake – 120

The PGDM Banking and Financial Services program (BFS) at IMT Ghaziabad is a young program that began in 2019, with the aim of creating a differentiated, premium, specialized, offering catering to the huge demand for multiple skill sets within the BFS space. The program is an AIU (Association of Indian Universities) accredited. AIU equivalence translates to the PGDM being equivalent to an MBA degree of an Indian University which is required by aspirants for the purpose to higher studies in India and abroad. The PGDM (BFS) program provides students with contemporary skills and knowledge that are relevant for managing core operations of firms operating in the banking and financial services sector. The goal of the programs is to groom budding managers who are not only immediately employable in core banking and financial services functions but who can be groomed as future BFSI leaders. The program is being restructured to give students the best blend of theory, practice, history, data and disruption.

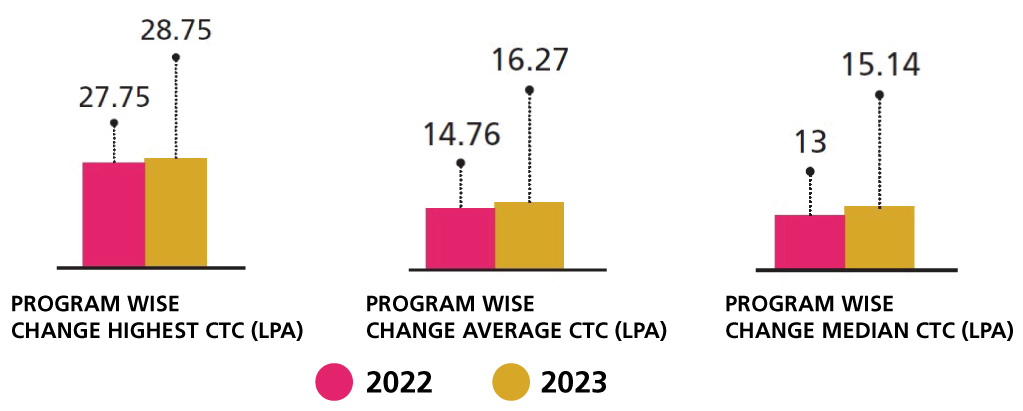

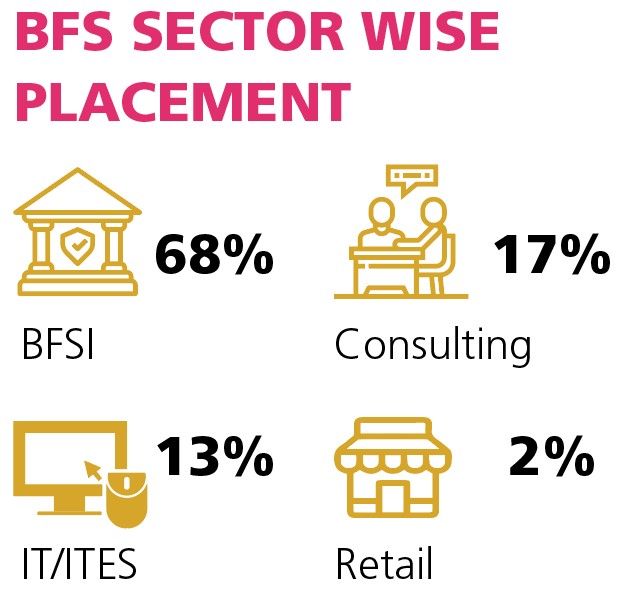

In a short duration of four years, the program has grown from strength to strength and is currently one of the most coveted program at IMTG, with many aspirants choosing this program as their first choice to do a PGDM. The growth of the program can also be measured from the differentiated curriculum aligned with the industry, the strong alliance with Vlerick Business School (Belgium) and the superior placement stats of the past 2 batches. During the past one year, the BFS cohort has the highest average placement stats among the programs offered at IMTG, and BFSI has emerged as the most prominent sector for recruitment at IMT for SIP and Final placements.

We also offer a range of domain-specific electives depending on recruiter feedback and student interest. In addition we are building a suite of flexible learning format courses that cover a number of contemporary and historical topics in the BFS world.

Foundation |

| Case Learning Pedagogy |

| Critical and Analytical Thinking |

| Introduction to Data Visualisation |

| Introduction to Python (R?) |

| Micro Economics |

| Personal Growth Lab |

| Problem Solving with EXCEL |

| Quantitative methods |

Management Skills |

| Behavioural Finance / Econ |

| Communication for Managers |

| Human Resource Management |

| Innovation and Entrepreneurship |

| Leadership and Negotiation |

| Marketing Management |

| Organizational Structure and Behaviour |

| Strategic Management |

Essential Finance and Economics |

| Business Valuation |

| Corporate Finance |

| Financial Accounting |

| Financial statement analysis |

| Macro economics and international monetary policy – data and market lens |

| Mergers, Acquisitions and Corporate Restructuring |

Digital Innovation in BFS |

| Basics of Database and SQL |

| Data Analytics and Artificial Intellegence |

| Digital strategy |

| Fintech |

| Machine Learning for BFS |

| Platforms, Ecosystems and Open Banking |

Essential BFS |

| Asset Liability & Capital Management |

| Contemporary topics in BFS – Flexible List of topics |

| Corporate banking – products, risks and relationship management |

| Financing Large Projects |

| Global Asset Allocation |

| Insurance Management |

| Introduction to Banking and Financial Services |

| Introduction to Fin Markets – Fx, bond, derivatives |

| Investment Banking |

| Marketing of Fin Services -1 (Retail products) |

| Navigating Bloomberg & Reuters |

| Operational excellence in services |

| Regulatory framework and expectation for BFS – India and International |

| Risk Management in BFS – 1, (treasury risk – liquidity, capital, ILAA, ICAAP) |

| Risk Management in BFS – 2( market risk, correlation, business model, concentration, wrong way) |

| Risk Management in BFS 3 – non-fin risks including ESG |

| Security Analysis and Portfolio Management |

| Venture Capital and Private Equity |

| Wealth management |

Essential BFS |

| SUMMER INTERNSHIP |

| TWO WEEK Bootcamp PRE SIP |

Our mission is to become one-stop destination for high quality talent for BFS industry.

We have successfully placed students in leading BFs institutions such as HSBC, Kotak Mahindra Bank, Bank of America, RBL, Natwest, Arcesium, Bony Mellon, ICICI, Barclays, HDFC, Morgan Stanley as well as leading consulting firms such as BcG, Deloitte, KPMG, Darashaw, & Protiviti. Given the materially higher levels of compensation in the BFs sector, as the program matures, we expect to see our students’ starting CTC to meet and beat average levels of the overall cohort.

|

|

|

LEARN ABOUT THE PROGRAM

Chairperson, PGDM Banking and Financial Services, IMT Ghaziabad